From Silk to Silicon: What Past Market Booms Can Teach Us About Navigating the Green Tech Revolution

Each market boom had its busts - some came to stay. All have some common themes. Here's a historical guide to navigating the Green and Emerging Tech Market Boom.

Introduction

Homo Sapiens are short sighted creatures, technologies and markets change but human nature does not. It doesn’t have to be that way - not for me, or you the reader if you heed histories lessons.

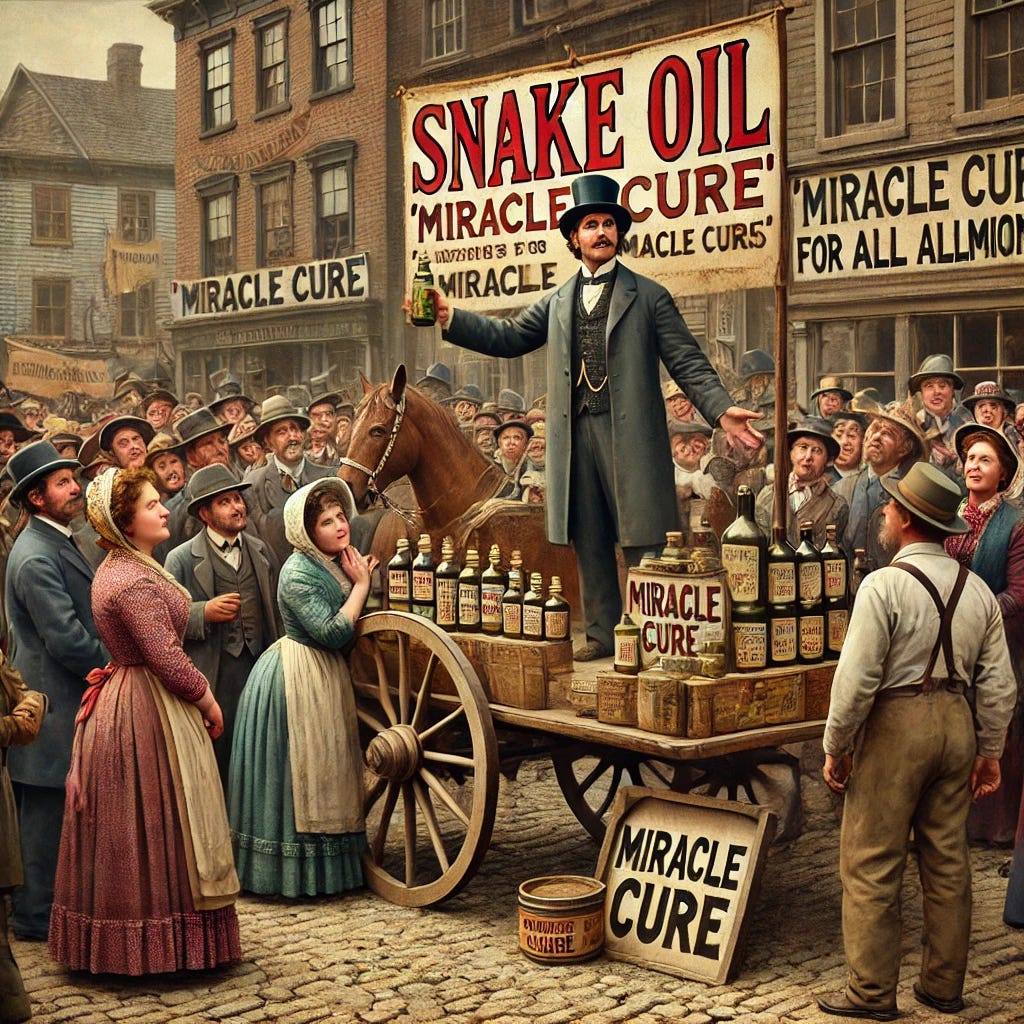

As the green tech market rears its head from the abyss of policy, opportunity and neceicity it should be well warned to keep this well-known adage in mind. “If it sounds too good to be true, it probably is.” A steady development of technological solutions, combined with well-managed environmental action, would have been the ideal approach. But much like a student scrambling to complete homework at the last minute, we’re hastily throwing new tech at environmental challenges, creating a fertile ground for poor decisions and flawed results.

This situation is compounded by the urgency of the stakes, the timeframes at play, and the parties involved. There is a pressing need to move quickly—but to do so with caution, wary of the snake oil salesmen within the ranks.

Emerging technologies, when used effectively, act as powerful tools—whether as lubricants that smooth processes or engines that accelerate outcomes. The key is to apply them in conjunction with robust, proven strategies rather than expecting them to be a silver bullet solution for solving complex issues like climate change or loss of biodiversity.

The challenges we’re witnessing today echo common phenomena seen in the rapid expansion of any new market seen accross history. By looking at lessons from past booms, we can better navigate the green tech explosion unfolding before us. Investors, founders, and conservation leaders—take note.

Counterfeiting and Market Saturation (Tea Boom, Silk Boom)

As tea and silk became coveted luxuries, counterfeit products flooded the market—lower-quality fabrics passed off as genuine silk, and tea leaves adulterated with other plants. This eroded consumer trust and destabilized prices.

Lesson for Green Tech: The green tech market is already seeing its own version of this, with "greenwashed" products and scandals like Shell double counted carbon credit’s. Companies making grandiose sustainability claims—especially oil companies—must be scrutinized. While establishing clear standards, regulations, and verification systems is vital, aligning sustainability strategies with genuine environmental impact is key. Avoiding the pitfalls of schemes that could lead to reputational damage, financial risk, or eventual obsolescence is crucial for long-term success.

~ Insights : Financial markets reguarly undergo ‘corrections’. Could this scandal inadvertently provide a correction of the carbon market, towards it’s genuine valuation? Rather than ‘damage’ the market, it may shift it towards more stringent regulation promoting more environmentaly measured approach to green tech uptake from organisations, encouranging more impactful strategy from businesses.

Consumer Adoption and Education (Dot-com Boom)

In the Dot-com era, consumers didn’t fully grasp the potential of new tech, stalling adoption. Similarly, early renewable energy technologies faced skepticism.

Lesson for Green Tech: Technologies like Web3 and AI face similar hurdles. Blockchain-based carbon markets or AI-driven smart grids are often misunderstood, and Web3’s conceptual complexity are often difficult sell’s. Companies must invest in education and transparency, making it clear how these innovations can genuinely reduce energy use and advance sustainability goals. Only then will mass adoption follow.

Further compounding this are issues plaguing Web3 like Crypto pump and dump schemes - another financial gambit from the history books, stretching back as far as 1720’s, the first of which even Sir Isaac Newton succumed too. Hesitancy towards the adoption of blockchain technologies, due to their association too these types of scams, has no doubtedly further slowed the progress of this tech entering mainstream markets.

~Insights: Focus on the long term trends, not short term pitfalls. Blockchain and AI hold real potential to drive climate action, but scams and bad practices need to be weeded out. Tightening regulations is a good sign—just as IPOs didn’t stop after the Stratmont Oaks scandal, green tech won’t be derailed by bad actors. Aligning emerging tech with genuine environmental benefits is crucial for creating lasting impact in the private sector.

Regulatory Uncertainty and Compliance (Telecommunications Boom, Oil Boom)

Both the telecom and oil booms were hindered by inconsistent regulations. The lack of clear standards fragmented markets, while stricter laws in oil created compliance hurdles.

Lesson for Green Tech: The carbon market faces similar regulatory chaos. Different rules for carbon credits and emissions trading create uncertainty for companies. Web3 and AI, too, wrestle with evolving laws. Companies must engage with regulators early to shape global standards, ensuring transparency and enabling broad participation in the carbon market.

~Insights: Growing pains being experienced in regulatory consolodation are part of the early stage process of any emerging sector. Due diligence is therefore required by businesses or investors, looking for well rounded projects, with tangible impact, diversified sustainability offerings or business models make them more resiliant to regulatory changes and market fluctuations.

The "Too Big to Fail" Fallacy (Dot-Com Boom)

During the Dot-Com Boom, overhyped companies expanded rapidly on speculative investments, leading to the crash of 2000 when many failed to deliver real results.

Lesson for Green Emerging Tech: Today, Web3 and AI-driven sustainability projects face similar risks. Hype around revolutionary carbon credits, renewable energy trading, and predictive analytics is growing. But if these technologies fail to show tangible impact soon, investor confidence could fade fast, triggering capital withdrawal and bankruptcies, much like the Dot-Com bust.

To avoid this fate, green tech companies must focus on measurable environmental outcomes instead of relying on speculation, ensuring long-term stability and avoiding the hype bubble.

Conclusions

The lessons of history are clear: rapid expansion, unchecked hype, and speculative investments often lead to market crashes and failures. As the green tech sector grows, we must be vigilant in learning from past booms and busts. Whether it’s counterfeiting in the tea and silk markets, consumer skepticism from the Dot-Com boom, or the regulatory hurdles of the oil and telecom industries, these historical parallels remind us that thoughtful, sustainable growth is key.

However, there are aspects of the green tech market that set it apart from past industries. The global response to climate change—reflected in the Paris Climate Agreement, COP meetings, and the growing environmental pressure from the undeniable effects of climate change that will inevitably unfold —suggests that this market is not just another fleeting trend. The increasing environmental consciousness, especially among young people, will also play a critical role as they emerge as the dominant financial force globally, demanding sustainable solutions and holding companies accountable. This market is born out of policy, necessity and people power.

This combination of international climate commitments and societal pressure signals that the green tech market is here to stay. But success in this sector depends on more than just riding the wave of urgency. Companies must focus on real, measurable impact, grounded in transparency and long-term strategy. Technologies like Web3 and AI offer powerful tools, but they need to be deployed wisely to avoid the pitfalls of hype and speculative mini-bubbles.

As we navigate the complex landscape of green tech, remember that success doesn’t come from rushing headlong into the next big thing. It comes from carefully aligning innovation with practical, well-managed strategies. Investors, founders, and leaders—heed these lessons, and build not just for the market of today, but for the environment and economy of tomorrow.